Core Principles of Value Investing

How value investing stands apart from growth and momentum strategies in today’s dynamic markets.

Value vs. Growth: Understanding the Fundamental Distinction

The differences between value and growth investing are substantial. Growth-oriented investors typically prefer innovative and/or younger companies expected to deliver strong revenue and earnings growth. As a result, they are often comfortable with high price-to-earnings (P/E) ratios and are less concerned about dividends.

In contrast, value investors tend to focus on mature companies operating in stable sectors. These companies usually trade at lower P/E ratios, pay regular dividends, and generate consistent cash flows. According to VanEck, value portfolios generally feature stocks with low P/E and P/B (price-to-book) ratios, high dividend yields, and relatively modest growth expectations. Growth stocks, on the other hand, are characterized by high P/E multiples, low or no dividends, and aggressive revenue expansion.

As some studies suggest, value stocks have historically exhibited lower volatility and more reliable cash flows than their growth counterparts. While growth stocks may thrive in bullish environments, value stocks offer more stability during downturns.

Value vs. Momentum Investing

Momentum strategies, unlike value investing, rely heavily on technical analysis and trend-following behavior. Momentum investors seek to buy stocks that are rising rapidly in the short term with the goal of “buying high and selling higher.”

This approach, popularized by investors like Richard Driehaus, stands in stark contrast to the philosophy of Benjamin Graham or Warren Buffett. Instead of identifying undervalued businesses, momentum traders capitalize on price action, relying on past performance and volatility rather than fundamental analysis.

To summarize:

Value Investing: Buying strong companies trading below their intrinsic value, often out of favor in the market.

Momentum Investing: Buying high-performing stocks in uptrends, regardless of valuation, to ride short-term gains.

Beyond Stocks: Are Other Asset Classes Suitable?

While value investing is primarily stock-focused, other asset classes such as commodities or cryptocurrencies often fall outside its framework.

Stocks represent ownership in businesses with tangible revenue and profit metrics, making them suitable for valuation through models like discounted cash flow (DCF). Commodities such as gold or oil do not generate cash flows and thus cannot be valued using traditional methods. For example, gold's value is largely influenced by inflation or monetary policy rather than intrinsic return-generating ability.

Cryptocurrencies, according to Warren Buffett, are also speculative and do not produce operational returns or intrinsic value. In his view, assets that do not create economic value cannot be considered suitable investments.

That said, companies operating within commodity sectors—like oil drillers or mining firms—can still be evaluated and considered under value principles. However, direct exposure to commodities or digital assets is generally outside the scope of classical value investing.

Academic Findings and Long-Term Data

Academic studies consistently show that value stocks have historically outperformed growth stocks over the long term. According to U.S. stock market data since 1927, value stocks have delivered an average of 4.4% higher annual returns than growth stocks.

Notably, between 2000 and 2004, the Russell 3000 Value Index outperformed its Growth counterpart by an annualized difference of ~15%, resulting in more than 93% total excess return during that period. This performance gap is often referred to as the “value premium.”

However, this premium does not remain constant. In certain cycles, growth stocks outperform for extended periods, as seen in the 2010s tech boom. Therefore, value and growth investing styles tend to alternate in dominance across different economic phases.

Moreover, value stocks typically exhibit lower volatility due to stronger balance sheets and more stable cash flows. Growth stocks, driven by aggressive projections, are more sensitive to macro shocks and investor sentiment.

Given this cyclical dynamic, many investors opt for blended portfolios that include both value and growth exposure to balance risk and return potential.

Conclusion

Value investing stands on the principle of buying solid businesses at a discount, focusing on fundamentals rather than hype. While it may not always outperform in the short term, its long-term resilience and margin of safety remain appealing—especially in uncertain or volatile markets.

With academic backing, historical outperformance, and the philosophies of legendary investors like Benjamin Graham and Warren Buffett, value investing remains a time-tested approach for building lasting wealth.

Sources:

Graham, B. (1949). The Intelligent Investor. Harper & Brothers.

Buffett, W. — Berkshire Hathaway Annual Letters.

Fama, E.F. & French, K.R. (1992). The Cross-Section of Expected Stock Returns, Journal of Finance.

VanEck – Growth vs. Value: What You Need to Know.

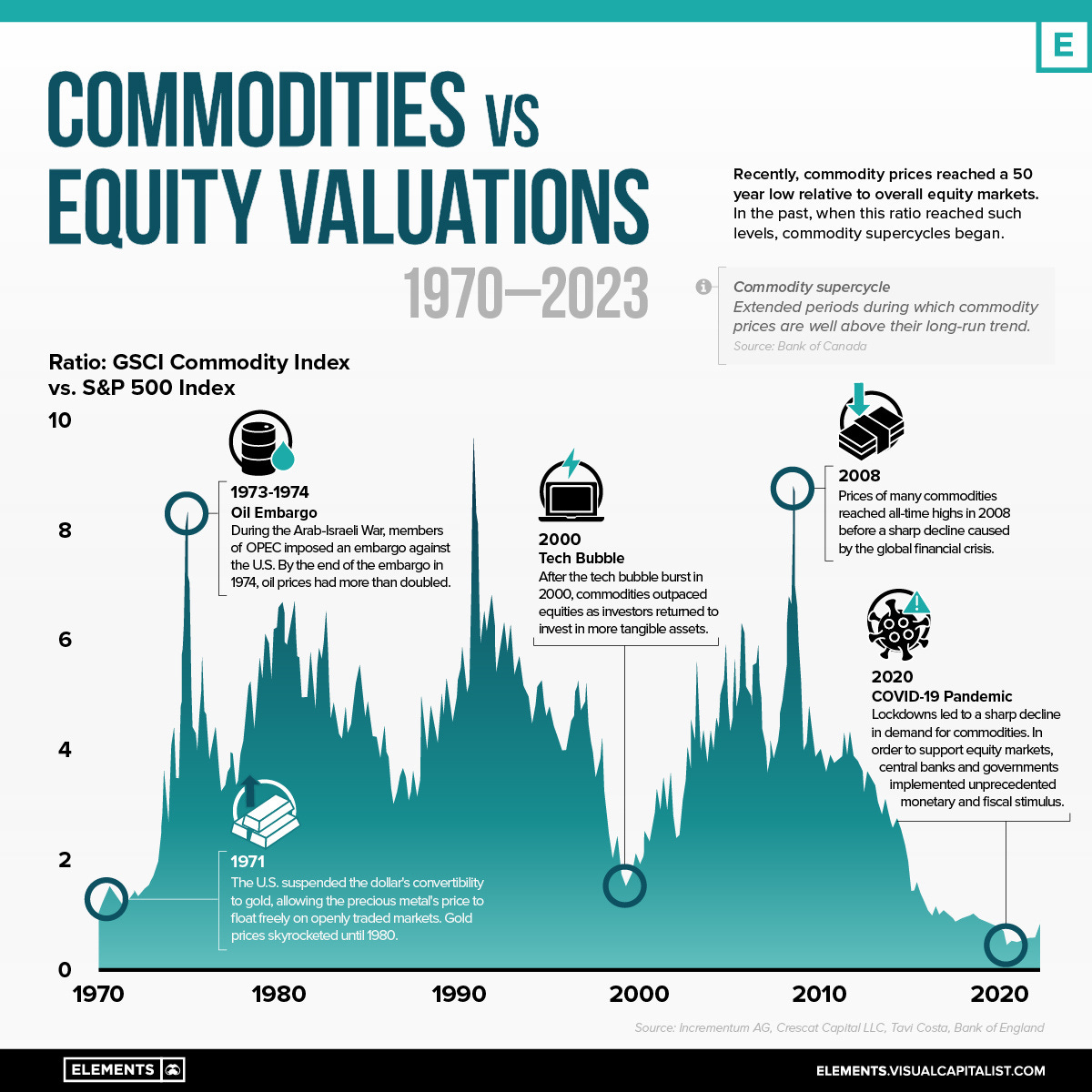

Visual Capitalist – The Long-Term Relationship Between Commodities and Equities.

Graham, B. (1949). The Intelligent Investor. Harper & Brothers.

Investopedia – Value Investing Definition.